Introduction to Auto Insurance Rates

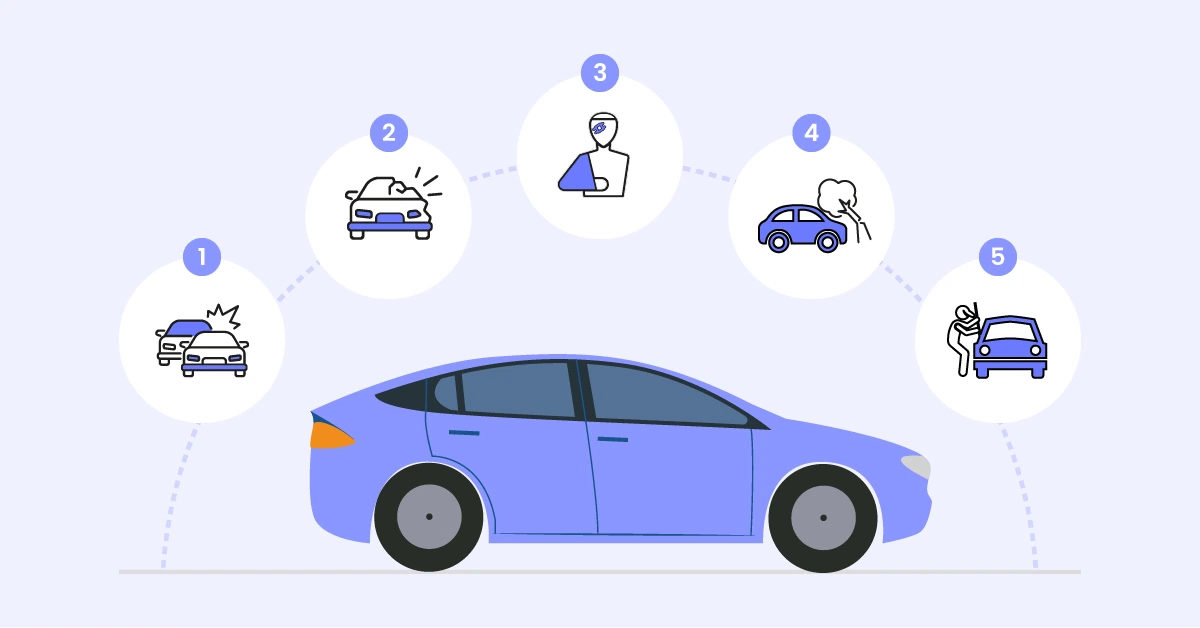

Auto insurance is an essential aspect of vehicle ownership, providing financial protection against physical damage and bodily injury resulting from traffic collisions, as well as liability that may arise from such incidents. In the United States, car insurance rates are primarily determined by several influencing factors, including the driver’s history, the type and age of the vehicle insured, and broader statistical data that reflect regional and national trends. While many individuals often operate under the assumption that their insurance premiums will only rise following an accident, there are multiple reasons why a policyholder might experience an increase in their car insurance rates.

Insurance companies utilize complex algorithms to assess risk and set premiums accordingly. Independent of accidents, factors such as credit scores, local crime rates, and changes in state legislation can lead to unexpected increases in premiums. For instance, if a driver’s credit score deteriorates, it can signal a higher risk to insurers, prompting an increase in rates. Additionally, if there is an uptick in claims within the driver’s geographic area, insurers might adjust rates for all policyholders accordingly, reinforcing the notion that calamities can impact more than just direct involvement.

Moreover, fluctuations in the market can influence insurance costs, including increases in repair costs, healthcare costs, and changes to vehicle technology that necessitate higher premiums. This leads many individuals to ponder the question, “why did my car insurance go up without an accident?” Understanding that numerous factors contribute to insurance rates can help consumers navigate their policy negotiations and address concerns regarding unexplained increases effectively. In the subsequent sections, we will explore specific causes of premium increases and their implications for drivers across the country.

Factors Influencing Car Insurance Premiums

Car insurance premiums are influenced by a multitude of factors, often leading to increases even in the absence of accidents. Understanding these variables can help policyholders navigate their insurance costs more effectively.

One of the primary factors is the driver’s age. Younger drivers, particularly those under 25, are statistically at greater risk of accidents, which often results in higher premiums. Conversely, older, more experienced drivers may benefit from lower rates. Additionally, gender plays a significant role; studies have shown that male drivers typically incur higher rates due to riskier driving behavior.

Location is another critical aspect. Insurance companies assess the risk associated with different areas based on crime rates, accident statistics, and severity of weather conditions. For example, urban drivers may face higher premiums owing to densely populated areas and a higher likelihood of accidents compared to rural drivers.

The type of vehicle being insured also impacts the premium. Sports cars or luxury vehicles often attract higher rates due to their cost of repair and increased likelihood of theft. Moreover, certain models may also be associated with a higher incidence of accidents, fueling the premiums for drivers of such vehicles.

Your driving history remains a central feature; however, premiums can be adjusted not only based on recent accidents but also on prior insurance claims, traffic violations, and overall driving behavior, including factors such as mileage and frequency of long-distance travel. This comprehensive evaluation results in premium adjustments that can leave many policyholders wondering, “why did my car insurance go up without an accident?” In the United States, such increases can seem perplexing, yet they reflect these multifaceted considerations.

In conclusion, the factors affecting car insurance premiums are diverse and often interconnected, contributing to potential increases independent of recent accidents. By understanding these elements, individuals can better manage their insurance expectations and costs.

The Impact of Credit Scores on Insurance Rates

Many drivers are often puzzled by changes in their car insurance premiums, especially when they have not experienced any accidents or claims. One significant factor that can lead to an increase in rates is an individual’s credit score. In the United States, insurers commonly utilize credit scores as a predictive measure of risk. Studies have shown a statistical correlation between credit scores and the likelihood of filing insurance claims. Therefore, when a consumer’s credit score decreases, it may result in higher car insurance rates.

The reasoning behind this practice can be traced back to the principle of risk assessment. Insurance companies aim to identify individuals who are more likely to incur losses. A lower credit score is often associated with financial instability, leading insurers to perceive these individuals as higher risk, even if they have a clean driving record. Consequently, drivers with poor credit ratings may experience an upward adjustment in their car insurance costs.

Moreover, the methodologies of various insurers can differ significantly, as some might weigh credit scores more heavily than others. This inconsistency means that the same individual could receive different premium quotes from various companies based on their credit history. For drivers inquiring, “why did my car insurance go up without an accident?” it is essential to consider the influence of credit scores as a vital component in their insurance premiums. Monitoring and improving one’s credit score can be a proactive step toward managing and potentially lowering car insurance costs in the future.

In conclusion, understanding the relationship between credit scores and insurance rates is crucial. For individuals facing rate increases, evaluating their credit score may provide insight into potential avenues for reducing costs, even when accidents are not a factor.

Understanding Rate Changes: Insurance Market Trends

The cost of car insurance is influenced by a myriad of factors that extend beyond individual driving records. One significant aspect that policyholders should understand is the broader insurance market trends, which can lead to increases in premiums even when no accidents occur. Over recent years, the insurance landscape in the United States has been affected by multiple external pressures that contribute to rate hikes.

Regional disasters play a pivotal role in shaping insurance premiums. For example, states that experience hurricanes, floods, or wildfires may see a universal escalation in insurance rates. This phenomenon is attributable to the increased risk that insurers face when providing coverage in disaster-prone areas. When such events lead to high claims, insurance companies recalibrate their risk assessments, often resulting in higher rates for all policyholders, irrespective of their personal driving history.

Furthermore, the increase in repair costs is another critical factor influencing car insurance rates. The modern vehicles on the road today come equipped with expensive technology and materials, leading to higher costs when repairs are necessary. This drives up costs for insurers, who must then translate these higher expenses to consumers. As a result, many policyholders wonder, “why did my car insurance go up without an accident?” The answer often lies in the rising costs associated with vehicle repair and replacement.

Inflation is a broader economic factor that cannot be overlooked. When overall inflation increases, the dollar’s purchasing power diminishes, leading to a rise in operational costs for insurance companies. This often manifests as increased premiums for policyholders across the board, leaving many questioning the necessity of such hikes when they have maintained a clean driving record. Understanding these market trends is crucial for consumers trying to navigate the complexities of their car insurance costs.

The Role of State Regulations in Premium Adjustments

In the United States, insurance premiums can fluctuate for a multitude of reasons beyond individual driving records or claims history. One significant factor that influences these changes is state regulations. Each state has its own set of laws and guidelines that govern how insurance companies operate, including how they calculate and adjust premium rates. Understanding these regulations can help consumers comprehend why did my car insurance go up without an accident.

For example, some states may enact new legislation that affects the overall risk assessment models used by insurance providers. A change in regulatory guidelines could cause insurers to reassess their risk pools, thereby increasing premiums across the board. This change could result from a shift in the legal or healthcare landscape, such as increased medical costs, which often influences the cost of automobile injuries and claims.

Furthermore, some states have implemented stricter consumer protection laws, resulting in insurers facing higher operating costs. These increases are typically passed on to consumers in the form of higher premiums. In addition, some states allow for an increase in premium rates after certain events in the industry, such as widespread natural disasters that may raise the risk profiles of a large number of drivers, irrespective of whether an individual has filed an insurance claim.

Moreover, regulatory bodies frequently conduct reviews of insurance companies to ensure they are maintaining adequate financial reserves. If a company finds itself needing to bolster these reserves due to poor financial performance, it might enact a statewide increase in premiums, impacting many drivers who might wonder why did my car insurance go up without an accident. Overall, it is essential for drivers to stay informed about their state’s insurance regulations to understand the dynamics at play in their premiums.

Changes in Your Personal Circumstances

Understanding why did my car insurance go up without an accident can be perplexing for many drivers. One of the key factors influencing insurance premiums is a driver’s personal circumstances, which can change over time. A common reason for an increase in insurance rates is an individual’s relocation. For instance, moving from a rural area to a more urban environment often leads to higher risk assessments by insurance companies due to increased traffic congestion, higher rates of accidents, and greater likelihood of vehicle theft. As insurance providers take these risks into account, the premiums may consequently rise.

Another significant personal change that can impact car insurance rates is a change in marital status. Studies have shown that married individuals often enjoy lower car insurance premiums compared to single drivers. This phenomenon is primarily because married couples are perceived as more responsible and less prone to risky driving behaviors. Therefore, if a driver becomes single, whether through divorce or other means, they may find their insurance rates unexpectedly increasing.

Additionally, acquiring new vehicles can also contribute to increased premiums. Generally, the make and model of a vehicle are critical factors in determining insurance costs. More expensive vehicles or those with high-performance capabilities may attract higher insurance rates due to the increased replacement cost and repair expenses. If one were to trade their vehicle for a newer or more expensive model, it would naturally lead to inquiries regarding why did my car insurance go up without an accident.

Ultimately, understanding how changes in personal circumstances influence car insurance premiums allows drivers to manage their policies effectively and ensures they are prepared for any potential increases.

The Effects of Claims from Other Drivers

When evaluating the reasons behind rising premiums, it is essential to understand the impact of third-party claims. A third-party claim occurs when another driver files a claim against your insurance following an accident, regardless of whether you were at fault. This mechanism can directly affect your insurance rates, as insurance companies assess the overall risk associated with insuring you based on these claims. If other drivers have made claims against similar policies, it may indicate an elevated risk level in your demographic, potentially leading to increased premiums for you, even if you haven’t filed any claims yourself.

In the United States, many states have adopted no-fault insurance laws. These laws are designed to simplify the claims process by allowing drivers to seek compensation for damages and injuries from their own insurance company, rather than from the driver at fault. The intention behind this system is to reduce legal disputes and ensure quicker reimbursements. However, while no-fault insurance aims to streamline interactions and maintain coverage levels, it can also contribute to higher premiums.

Under a no-fault insurance system, insurance companies are required to cover certain expenses right away. This increased obligation can lead insurers to raise rates across the board, as they must account for the potential payout for all drivers within the same geographical area or insurance pool. Consequently, if you are asking yourself, “why did my car insurance go up without an accident?” it is worth considering external factors, such as third-party claims and the influence of no-fault laws in your state. In particular, if claims frequency rises among other drivers, even unrelated to your personal driving record, you may still witness an upturn in your own insurance premiums.

How Insurance Companies Calculate Risk

Insurance companies utilize a variety of algorithms and risk assessment models to calculate premiums for auto insurance policies. These assessments are essential for determining the likelihood of a policyholder filing a claim, which directly impacts their premiums. Understanding the underlying metrics can provide clarity on why did my car insurance go up without an accident.

One of the primary methods employed by insurers is an analysis of driving behavior, which includes considerations such as mileage driven, driving history, and the type of vehicle insured. Even if a driver has not been involved in an accident, factors like a sudden increase in mileage or a shift to a type of vehicle associated with higher claims can result in an elevated risk score. This reevaluation can lead to increased premium rates. Additionally, insurance providers assess broader trends in the region where the vehicle is registered. If there is a spike in claims or accidents in a local area, all drivers in that area may see increased premiums, regardless of their individual driving records.

Moreover, insurers examine credit scores and other personal financial factors that might indicate a policyholder’s risk level. In the United States, statistical data correlating credit ratings with insurance risk has been acknowledged, often leading to higher premiums for those perceived as higher-risk customers. Thus, fluctuations in a person’s credit standing could cause their insurance rates to rise even if they have maintained a clean driving record.

In essence, various external and internal metrics contribute to the overall assessment of risk. These insurance calculations factor in numerous elements beyond just accidents, culminating in potential premium increases even when a driver has not experienced any personal incidents. Therefore, if you find yourself asking, “why did my car insurance go up without an accident?” it may be worth exploring these varied factors influencing your insurance premium comprehensively.

Conclusion: What to Do If Your Rates Increase

Experiencing an increase in your car insurance premium can be concerning, especially when the rise is unexpected, and there has not been an accident. Many drivers across the United States wonder, “why did my car insurance go up without an accident?” Understanding the causes behind these increases is crucial, but it’s equally important to know your options moving forward.

One effective strategy is to shop around for new quotes. Insurance companies may have different underwriting criteria, which can result in varying premium rates for the same coverage. Taking the time to get multiple quotes from different insurers could reveal more competitive rates, potentially saving you money.

Additionally, consider asking your current insurance provider about discounts that may be available. Many companies offer various discounts, such as those for safe driving records, bundling policies (like home and auto insurance), or being a member of certain organizations. Bringing these opportunities to your insurer’s attention could lead to a reduction in your premium.

If these steps do not yield satisfactory results, it may also be worthwhile to have a conversation with your insurance agent. They can provide personalized advice based on your specific situation, explaining the reasons for the rate increase and suggesting tailored strategies to mitigate it. Information such as credit score impacts, changes in local laws, or adjustments in claims history may also influence your premium.

In conclusion, facing a rise in car insurance rates without an accident can be daunting. By actively seeking alternative quotes, inquiring about discounts, and consulting with your agent, you can better understand the reasons behind the increase and explore avenues to reduce your premium effectively.

FAQ: Why Did My Car Insurance Go Up Without an Accident

Q: I didn’t get into an accident. Why did my car insurance increase?

A: Car insurance companies consider many factors beyond accidents. Even if you had no collisions, your rate can increase due to changes in risk assessment, claims trends, or company pricing decisions.

Q: Does my credit record affect my car insurance costs?

A: Yes. Many insurers use credit‑based insurance scores to help set rates. If your credit score dropped, your premiums could go up even without an accident.

Q: Can inflation or general cost increases impact my premium?

A: Absolutely. Rising costs for vehicle repairs, medical expenses, and insurance payouts generally push premiums higher across the board.

Q: Did a change in my driving record (like a traffic ticket) affect it?

A: Yes. Even non‑accident driving violations such as speeding or red‑light tickets can increase your insurance rates because they indicate higher risk.

Q: Did my insurance company raise rates for everyone?

A: It’s possible. Insurers periodically adjust rates based on statewide or national trends, more claims, or changes in regulatory conditions. That can increase your premium even with a clean record.

Q: Does where I live matter?

A: Yes. Your ZIP code impacts your premium. If crime, accidents, or claims increase in your area, carriers may raise rates for all drivers there.

Q: Did changes to my coverage cause the increase?

A: If you updated your policy (higher coverage limits, lower deductible, adding drivers, or new vehicles), that can raise your premium even if you haven’t had an accident.

Q: Could changes in my personal situation affect my rates?

A: Yes. Changes like adding a teen driver, a change in marital status, or moving to a new address can change your risk profile and raise rates.

Q: Does age affect my car insurance cost?

A: Yes. Younger drivers and older drivers often pay more. If you’ve recently entered a different age bracket where risk assumptions change, premiums can go up.

Q: Can changes in the insurance company’s internal pricing affect me?

A: Yes. Insurance companies use complex models to calculate risk. If their models or rate structures change, your premium can increase even without claims.

Q: What if I didn’t change anything and my insurance still went up?

A: Insurers routinely review portfolios. If overall claims have increased or underwriting results worsened, they may raise rates across many customers as part of annual pricing changes.

Q: How can I lower my car insurance after a rate increase?

A: You can shop around, compare multiple insurers, adjust coverage amounts, consider higher deductibles, earn discounts (good driver, multi‑policy, safe vehicle), or improve your credit score over time.

Q: Should I contact my insurer to ask why my rate increased?

A: Yes. Your insurer can explain the specific reason for your premium change and whether any discounts apply to you.

Read More:

- Erie Insurance vs Insuracarelife: A Comprehensive Guide to Home Insurance in NYC

- Understanding the Cost of Commercial Auto Insurance in Texas: Monthly Breakdown

- Cheapest Personal Insurance Plans in New Jersey: Affordable Coverage for Every Need

- General Motorcycle Insurance in Florida – Coverage, Benefits, and What You Need to Know

- Allianz Travel Insurance vs Berkshire Hathaway Travel Insurance: Which is Better in the United States?