Insurance Services

Insurance services encompass a range of products designed to provide financial protection against potential risks and uncertainties. In Ohio, individuals and businesses have access to various types of insurance products, including auto, home, renter’s, health, and life insurance. Each type of insurance addresses specific needs and circumstances, ultimately offering peace of mind in the face of unforeseen events.

Auto insurance is essential for vehicle owners, as it protects against financial losses resulting from accidents, theft, or damage. Home insurance serves a similar purpose for homeowners, safeguarding property against risks such as fire, vandalism, or natural disasters. For renters, renter’s insurance offers coverage for personal belongings, ensuring that individuals are protected even when they do not own the property they inhabit. Health insurance is vital for managing healthcare costs, providing access to medical services while mitigating the financial burden of illness or injury. Lastly, life insurance offers crucial support for beneficiaries in the event of the policyholder’s passing, helping to cover expenses and maintain financial stability.

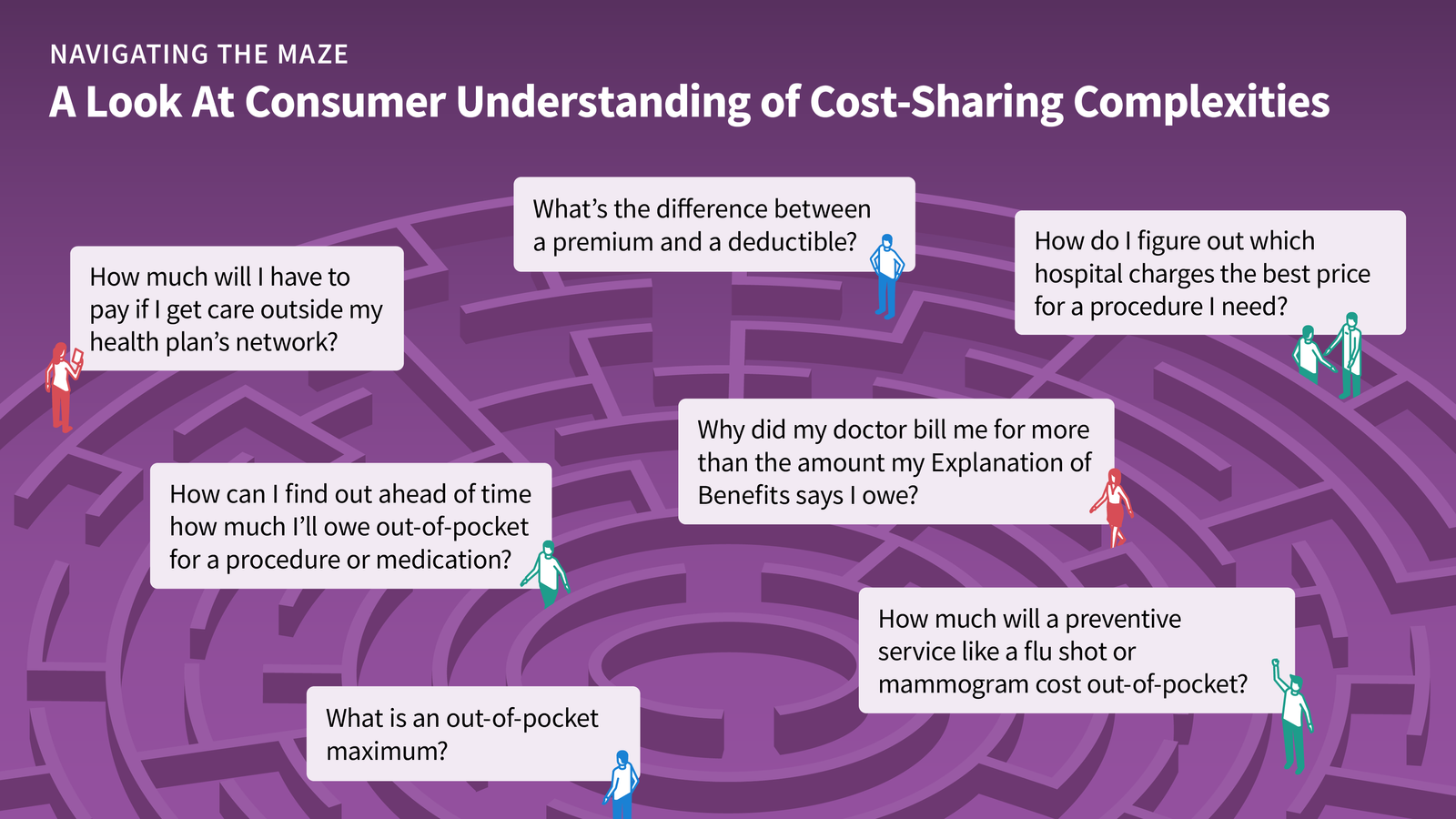

Understanding key concepts in insurance is necessary to comprehend how these services function. Premiums refer to the amount policyholders pay, typically on a monthly basis, to maintain their coverage. Deductibles, on the other hand, are the out-of-pocket expenses that must be paid before the insurance provider starts to cover costs. Additionally, coverage limits dictate the maximum amount an insurer will pay for a particular claim, making it essential for policyholders to choose limits that align with their needs and potential risks.

In Ohio, insurance services are regulated to ensure that consumers receive fair treatment and adequate options. By familiarizing oneself with different insurance products and their associated terms, individuals can make informed decisions, selecting the insurance services that best fit their unique situations and financial goals.

Assessing Your Insurance Needs

Understanding your insurance needs is a crucial first step in securing the appropriate coverage for yourself or your business. Several factors will influence the amount and type of insurance required, including your current life stage, asset value, location, and overall exposure to risks. Each of these elements plays a significant role in determining the right insurance service provider and the policies they offer.

Your life stage is a fundamental consideration when assessing insurance needs. For instance, those in their early years may prioritize health and auto insurance, while individuals with families might consider life insurance or homeowners insurance. Additionally, the value of your assets is pivotal; high-value properties, accumulated wealth, or expensive collections may necessitate additional coverage to protect against potential losses.

Location is another critical aspect in evaluating insurance coverage. Ohio residents should stay informed about state regulations and local laws that might affect their insurance options. For example, specific coverage might be required for flood zones or areas prone to natural disasters, which can influence policy premiums and availability. Additionally, the unique climate of Ohio presents risks like extreme weather, which can affect property coverage and liability insurance.

Determining your risk exposure involves assessing potential liabilities that could arise from your personal or business activities. Consider questions such as: What are the possible legal liabilities? What environmental factors could impact my property? Furthermore, you may want to consult with experienced professionals to gain insights into local risk factors that could inform your insurance requirements.

By thoughtfully examining these factors, you can make well-informed decisions before approaching an insurance provider. By understanding your unique situation, you will be better equipped to select a policy that aligns with your needs in the context of Ohio’s specific economic and environmental landscape.

Choosing the Right Insurance Provider in Ohio

Selecting a reliable insurance service provider in Ohio is a critical decision that can significantly impact your financial security and peace of mind. To make an informed choice, it is essential to consider several key criteria. First and foremost, assess the company’s reputation. Research customer reviews and ratings to gauge the experiences of other policyholders. Websites, forums, and social media platforms can provide insights on customer satisfaction and complaints, contributing to a comprehensive understanding of the provider’s standing in Ohio.

Another vital factor is customer service. Evaluate the responsiveness and helpfulness of the provider’s representatives. Accessibility to agents for questions and support plays a significant role in the overall experience. Additionally, financial stability must be scrutinized. Utilize resources such as A.M. Best or Standard & Poor’s ratings to investigate the provider’s financial health. A company with strong financial performance is more likely to honor claims and provide reliable coverage over the long term.

The claims handling process is equally important. Investigate how quickly and efficiently claims are processed. Reading reviews specifically about the claims experience can offer valuable information. It is also advisable to obtain multiple quotes from different providers. This not only provides insight into competitive pricing but also helps in comparing the coverage options available. Understanding policy terms is crucial; ensure that you carefully read the fine print to avoid any surprises in case of a claim.

In Ohio, there are numerous insurance providers known for their quality service. Local companies such as Grange Insurance and Nationwide Insurance have established a solid reputation in the community. Additionally, national providers like State Farm and Progressive offer a wide range of products catering to various needs across the state. By considering these factors and conducting thorough research, individuals can choose the insurance provider that best aligns with their specific requirements.

The Process of Purchasing Insurance

When embarking on the journey to purchase insurance, whether for auto, home, health, or life, it is crucial to follow a structured process to ensure that you select the coverage that best fits your needs. The first step typically involves obtaining quotes from various providers. Many companies in Ohio offer online quote tools, facilitating the collection of multiple estimates quickly. It is advisable to request quotes from at least three different insurers to compare not only prices but coverage options as well.

During the application process, insurers usually require personal information and details specific to the type of insurance being sought. For instance, when purchasing auto insurance, you may need to provide vehicle identification details, driving history, and personal identification. Home insurance applications often ask for property details, including the age of the building, previous claims history, and security features. Understanding the required information ahead of time will streamline your application and prevent unnecessary delays.

While comparing different policies, pay close attention to the coverage limits, deductibles, and any additional features or riders that may be offered. It is equally essential to read the fine print, as policies can include exclusions and limitations that may impact your coverage. Consulting with insurance agents or brokers can be beneficial, as they can offer valuable insights and help clarify complex policy details.

After you have selected and purchased your insurance policy, it is important to understand what follows. Most insurance policies are subject to annual renewal, during which you may need to provide updated information or make adjustments to your coverage based on changing life circumstances. Additionally, reviewing your policy periodically ensures that it meets your current needs, considering factors such as changes in assets or family situations. Following these steps will lead you to a more informed and confident decision when purchasing insurance.